What's included?

23

Modules1

1 ON 1 COACHING50 +

TEMPLATES100 K

COMMUNITY∞

Unlimited Access

What You Will Learn

How to quickly determine what type of business is absolutely right for you.

The key points to identify good businesses or potential problems in business for sale listings.

Insider guidance to solicit the ‘hidden market"’ of businesses not publicly listed for sale.

The 36 critical questions you must ask every seller, and the answers to look for.

The 10 Commandments – the ten most important factors that every good business must have in place for you to buy it.

A proven formula to accurately value any type of business so you don't overpay.

How to properly use a business broker so you'll see the best listings first.

Winning techniques to have the advantage when you negotiate the 50 critical clauses of the deal.

Strategies to get any seller to finance the deal.

A detailed action plan using our trademarked 200-point due diligence checklist and business investigation guide to uncover all potential problems before you buy.

How to recognize and avoid all the costly mistakes that most inexperienced buyers make.

Curriculum – click each lesson to read the topics covered

Expert Help At Every Step

We help and mentor you at every step. Whenever you have questions, we will guide and advise you, and there is never any cost to you. If you need advice deciding what type of business is right, or reviewing a listing, help with negotiating, analyzing the financials, compiling a valuation, preparing for, and conducting the due diligence, or anything else, simply email us the details. Richard and his team will review the situation and provide you with a detailed response within one business day, and where necessary, set up a call with you to explain further. Best of all, there is never any charge for this service and you can use it as often as you want.

Course Price: $197

What Do I Get With the Course?

- The complete 23 lesson course - How To Buy A Good Business At A Great Price©

- Unlimited Personal Consulting

- Due Diligence Master Program and 200-point checklist

- Valuation Module - The Diomo Business Assessment™ method - fully automated. The industry's gold standard tool for accurately valuing a business

- Legal Forms

- Letter of Intent Templates

- Offer to Purchase Agreement Template

- Case studies

- Sample direct solicitation letters

- True Valuation Calculation formula

- 5 bonus industry specific guides

- All program exhibits

- Employee evaluation Q & A

- Study guide and journal

- Due Diligence reference sheets

- Letter templates for seller follow up

- Pro Forma forecasting spreadsheets

- Personal Financial Statement worksheet

- Sample legal clauses you must include in any agreement

Our Guarantee

Our ‘How To Buy A Good Business At A Great Price©‘ course comes with a straightforward Lifetime Money-Back Guarantee. If you ever feel the course hasn’t met your expectations, just reach out to us—no questions asked—for a full refund. This commitment reflects our confidence in the course’s ability to guide you successfully through business acquisition and our dedication to your satisfaction and success.

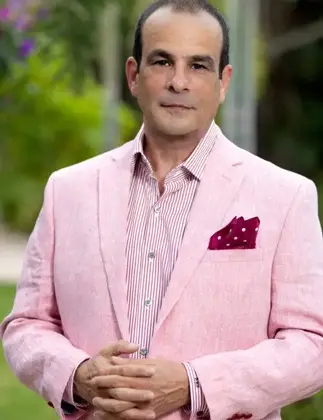

About Richard Parker

Your No BS Expert To Help You Buy Your Dream Business

Hi, I’m Richard Parker, I will teach you everything you need to know about buying businesses. With more than three decades of experience under my belt, I’m here to cut through the fluff and give you practical, no-nonsense advice that actually works. I know EXACTLY what every prospective buyer is going through because I have gone through it myself having purchased 13 businesses and looking at hundreds of potential deals.

I know how frustrating and difficult it can be to deal with unresponsive brokers, misleading business-for-sale ads, sellers who misrepresent their financials, looking at endless listings, businesses loaded with problems that are presented as being great opportunities, and trying to figure out what is the right business to buy. I will personally guide you at every step.

My flagship course, ‘How To Buy A Good Business At A Great Price©’ has helped thousands of aspiring entrepreneurs like you achieve their dreams of business ownership. I won’t sugarcoat anything—I’m here to provide you with the real, proven strategies and tools you need to succeed.